Nvidia turned San Jose into an AI hub this year, drawing a record-breaking crowd of 25,000 to its GTC 2025 conference. The city’s convention center and nearby venues were packed, with attendees filling every corner — even sitting on the floor — while organizers scrambled to keep the event orderly.

At the center of it all was Nvidia, still riding high as the undisputed leader in the AI chip market. With sky-high profits and no serious competition — yet — the company used GTC to showcase its next big bets. But as Nvidia’s dominance grows, so do the challenges threatening its stronghold. Looming tariffs, rising competition like DeepSeek, and shifting priorities from major AI players now cast a shadow over its future.

Nvidia’s Grand Pitch: New Chips, Personal AI Supercomputers, and Robots

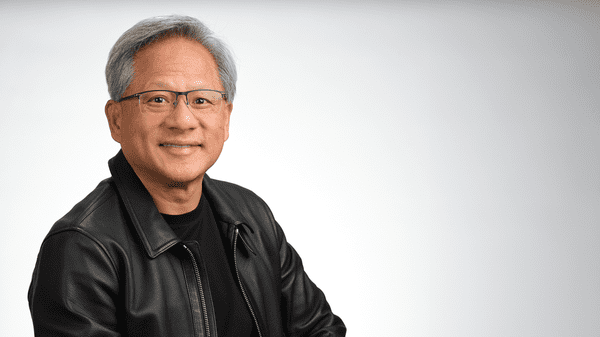

Nvidia CEO Jensen Huang took the stage with his signature confidence, unveiling powerful new GPUs, cutting-edge AI hardware, and even adorable robots designed to charm investors and customers alike. It felt like a full-blown sales pitch — aimed at reassuring stakeholders as Nvidia’s stock faced recent dips.

“The more you buy, the more you save,” Huang quipped during his keynote. “In fact, the more you buy, the more you make.”

His message was clear: Nvidia sees endless growth ahead — if buyers stick with them.

Powering Through the Inference Boom

A major theme at GTC 2025 was quelling fears that Nvidia’s golden run might slow down. Speculation had swirled that AI development might pivot away from massive, power-hungry chips like Nvidia’s. But Huang pushed back hard.

He singled out DeepSeek — the Chinese AI lab that recently shook up the industry with its efficient R1 model — as an example of misunderstood fears. Some investors worried this shift toward leaner AI models could undercut demand for Nvidia’s expensive hardware.

Huang disagreed. He argued that new “reasoning” models will need even more computing power, especially for inference tasks. To back that up, Nvidia revealed its next-gen Vera Rubin GPUs, promising twice the inference performance of its current Blackwell chips.

Still, Huang spent noticeably less time addressing the growing number of cheaper alternatives entering the market.

Rising Competition: Custom Chips and Cloud Rivals

While Nvidia took the spotlight, the competition quietly tightened. Emerging players like Cerebras and Groq — along with major cloud providers — are racing to build lower-cost inference hardware.

Big tech giants aren’t standing still either. Companies deeply reliant on Nvidia — including OpenAI and Meta — are aggressively developing their own chips to break free from Nvidia’s grip. Amazon’s Graviton and Inferentia, Google’s TPUs, and Microsoft’s Cobalt 100 all signal the same trend: AI leaders want alternatives.

That reality spooked investors, sending Nvidia’s shares down about 4% after Huang’s keynote. Many hoped for a game-changing announcement or accelerated rollout plans. Neither came.

Tariffs Loom as Another Growing Threat

Nvidia also used GTC to calm fears about potential U.S. tariffs. For now, Taiwan — home to much of Nvidia’s chip production — remains untouched by new trade restrictions. Huang reassured attendees that any impact would be minor in the short term.

But he carefully avoided promises about the long run. Any significant tariff changes could squeeze Nvidia’s margins — especially as the company plans massive U.S. manufacturing investments in response to the “America First” push. While this may ease supply chain risks, it also brings eye-watering costs that could test Nvidia’s profitability.

Betting on Quantum and the Future of AI PCs

Looking beyond chips, Nvidia is placing bets on new growth areas. At GTC’s first-ever Quantum Day, Huang made headlines by apologizing to quantum leaders for his earlier comments that downplayed the tech’s short-term value — remarks that triggered a stock dip for quantum firms.

To make amends and show commitment, Nvidia announced the launch of the Nvidia Quantum Center (NVAQC) in Boston. This new facility will work alongside top quantum companies to simulate complex systems and tackle challenges like quantum error correction — all powered, of course, by Nvidia chips.

Personal AI Supercomputers: Nvidia’s Next Big Consumer Play?

Perhaps the boldest reveal came when Huang introduced Nvidia’s push into personal AI computing. The new DGX Spark (formerly Project Digits) and DGX Station are designed to let users develop, test, and run AI models right at the edge.

These machines won’t be cheap — prices run into the thousands — but Huang painted them as the future of personal computing.

“This is the computer of the AI age,” Huang declared. “This is what computers will look like — and what they’ll run — from now on.”

Whether customers will embrace this expensive new vision remains to be seen. But one thing’s certain — Nvidia is betting big that AI’s future is still firmly in its hands.