The quantum computing industry is witnessing an unprecedented surge in venture capital investments, setting a new benchmark for funding in the sector. Last month, QuEra Computing, a quantum computing startup, secured a massive $230 million funding round from major investors, including SoftBank’s Vision Fund unit and Google Quantum AI. Shortly after, Israel-based Quantum Machines followed suit, raising $170 million in a Series C round led by PSG Equity.

Quantum Investments Hit All-Time High

The record-breaking funding rounds indicate a strong year ahead for quantum startups. In 2024 alone, venture-backed quantum startups raised a staggering $1.9 billion across 62 funding rounds, according to Crunchbase. This marks a 138% increase from the $789 million raised in 67 rounds in 2023, demonstrating a growing appetite for investment in quantum computing.

A key contributor to this significant growth was PsiQuantum, a Palo Alto-based startup, which secured a $594 million financial package from the Australian Commonwealth and Queensland Government. The funding, a combination of equity, grants, and loans, will support the development of a quantum computing facility near Brisbane Airport in Australia.

Even without the PsiQuantum deal, last year’s total investment would have nearly matched the previous high of $1.5 billion recorded in 2022.

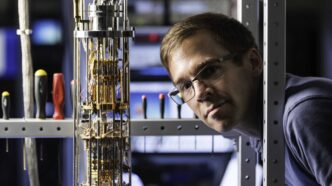

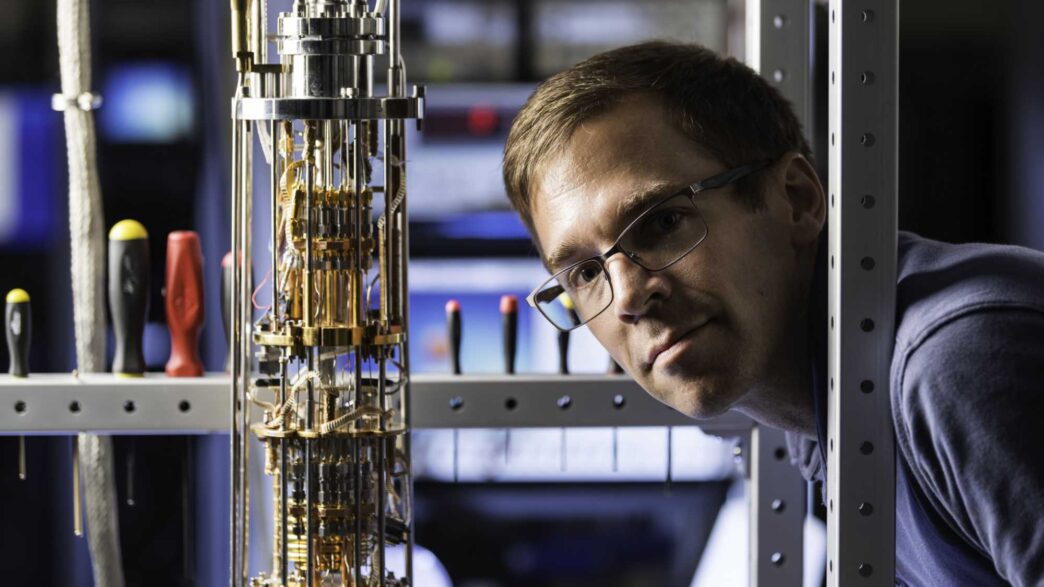

Breakthroughs Driving Investor Optimism

The surge in funding is fueled by major advancements in quantum technology from industry leaders such as Google and IBM. These milestones continue to generate excitement among venture capitalists eager to invest in the next big quantum startup.

Adding to the momentum, Microsoft recently announced the creation of a new state of matter in its pursuit of developing a powerful machine utilizing a “topological qubit.” This breakthrough underscores the rapid progress being made in the field and further strengthens investor confidence.

Beyond PsiQuantum’s funding round, several other startups have raised significant capital in recent months:

- Quantinuum (Broomfield, Colorado) raised a $300 million equity round in January, reaching a pre-money valuation of $5 billion. The company was formed through the 2021 merger of Honeywell’s quantum division and Cambridge Quantum Computing.

- SandboxAQ, an AI and quantum computing startup spun off from Alphabet, secured a $300 million investment in late December, bringing its valuation to $5.6 billion.

- Quantum Machines, which specializes in quantum computing hardware and software solutions, raised a $100 million venture round in early 2023.

- Riverlane, a UK-based company focused on quantum error correction technology, secured a $75 million Series C round in August.

The Future of Quantum Computing Investments

Experts anticipate that 2025 will mirror last year’s growth trajectory for quantum computing investments. A major driving force behind this optimism is the rapid expansion of generative AI, which requires extensive computing power. Quantum computing is poised to address these computational demands while offering improved energy efficiency compared to traditional data centers.

Despite requiring extreme cooling conditions, quantum computers could be up to 100 times more energy-efficient than conventional supercomputers for complex calculations. This advantage is drawing significant attention from industries such as healthcare, biotech, financial services, and defense, further fueling investor interest.

As quantum technology continues to evolve and demonstrate its potential, venture capitalists are unlikely to pass up the opportunity to invest in an industry set to redefine computing capabilities for years to come.

For more startup news, click here.