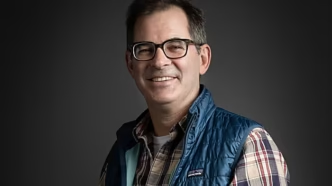

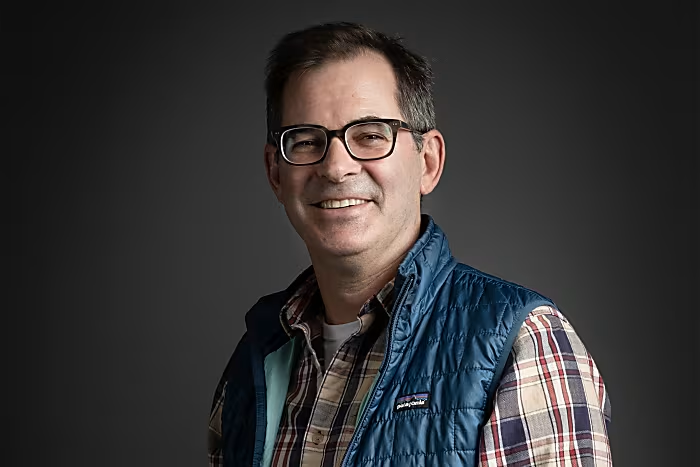

In 2016, three New York commodities traders — Michael Intrator, Brian Venturo, and Brannin McBee — stumbled upon Bitcoin during their fantasy football and pool games. They quickly became hooked, fascinated by crypto’s volatility and potential.

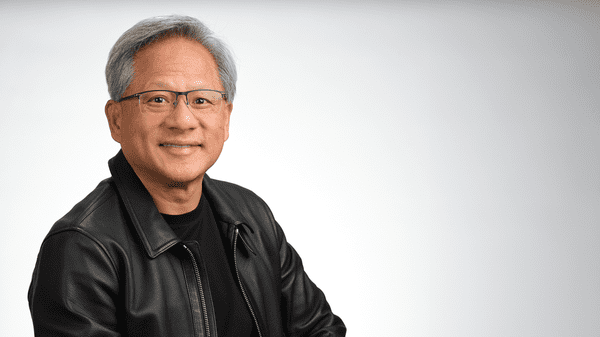

What began as a side bet soon turned into a business opportunity. Eager to get deeper into the crypto world, the trio bought two Nvidia graphics processing units (GPUs) from Amazon, powerful chips capable of mining digital currencies. As their interest grew, so did their collection of GPUs, eventually filling a garage and a nearby warehouse.

By 2017, they formally launched Atlantic Crypto, dedicated to mining cryptocurrencies. But when crypto prices crashed two years later, the founders saw the writing on the wall. They rebranded the company as CoreWeave and took a bold step — raising capital to buy GPUs from struggling miners. Their bet was simple: these same chips could soon power something much bigger — artificial intelligence.

Their gamble paid off. By the time OpenAI introduced ChatGPT in 2022, AI had become the tech world’s hottest commodity. Demand for processing power skyrocketed — and CoreWeave was perfectly positioned.

Ready for Wall Street’s AI Test

Now, CoreWeave is gearing up for its next big leap — the stock market. The company recently filed for an initial public offering (IPO), aiming to become the first major AI-focused startup to go public. If successful, the IPO would not only validate CoreWeave’s strategy but also offer investors rare direct exposure to the booming AI sector.

Unlike tech giants like Google or Nvidia, CoreWeave is what insiders call a “pure AI play.” Their entire business revolves around providing GPU computing power for AI projects. This makes them a prime target for investors eager to ride the AI wave.

“It’s the first major AI IPO this year and fits right into the narrative everyone’s chasing,” said Brianne Lynch, Head of Market Insight at EquityZen.

Nvidia, OpenAI Deals Cement CoreWeave’s AI Credibility

Headquartered in Livingston, New Jersey, CoreWeave may operate far from Silicon Valley, but it boasts serious tech industry ties. Nvidia holds a 4% stake and supplies most of CoreWeave’s chips. Just last week, CoreWeave locked in a landmark deal with OpenAI — a contract worth up to $12 billion. As part of the agreement, OpenAI will also invest $350 million when CoreWeave lists publicly.

With $2.3 billion raised in venture funding and a private valuation of $19 billion, CoreWeave is reportedly eyeing a $35 billion market debut this month.

Skyrocketing Revenues, Soaring Losses

CoreWeave’s growth has been nothing short of explosive. Last year, its revenue jumped to $1.9 billion from just $229 million the year before. However, this rapid expansion came at a cost. CoreWeave posted an $863 million loss after pouring nearly $1 billion into building new data centers.

According to Mark Klein, CEO of SuRo Capital and a CoreWeave investor, the company hopes to raise around $4 billion through the IPO. If successful, it could spark a wave of other AI startups going public.

A Scrappy Beginning, Built Like Traders

Intrator, Venturo, and McBee’s journey wasn’t without hurdles. The trio, who met working at a hedge fund in 2006, initially survived by raising money from wealthy traders and family offices. At one point, they worried that their stockpile of GPUs would overheat their Manhattan office, forcing a move to Venturo’s grandfather’s garage.

By 2018, they were already pitching investors on diversifying into high-end graphics, animation, and visual effects — industries hungry for GPU power. According to early investor Nic Carter, they approached the business like seasoned traders, buying GPUs cheap from distressed miners and flipping them for AI-driven demand.

The Breakthrough: AI’s Explosive Demand

The real breakthrough came in 2021 when hedge fund Magnetar invested $50 million. Then, ChatGPT’s debut in 2022 sent demand for AI computing through the roof. Within months, CoreWeave secured $7 billion in contracts with AI labs.

By April 2023, Nvidia had invested $100 million more, following another $200 million from Magnetar. To fund aggressive expansion, CoreWeave secured $2.3 billion in debt, using their GPUs as collateral.

Today, CoreWeave operates 32 data centers across the US and Europe and employs around 800 people.

Founder Paydays, Market Power, and Risks Ahead

As CoreWeave prepares to go public, its founders have already cashed out, selling over $150 million in stock each. Collectively, they retain 30% ownership and control 80% of voting power through special shares. Meanwhile, Magnetar is the largest shareholder with a 25% stake.

But challenges loom. Tech giants like Amazon, Microsoft, and Google dominate cloud computing and AI infrastructure. CoreWeave also faces revenue concentration risk — Microsoft accounted for 60% of its revenue last year.

Microsoft CEO Satya Nadella called the deal a “one-time thing” due to the chip shortage after ChatGPT’s release. These contracts end in 2029, and Microsoft is already investing billions in its own AI data centers.

Diversifying Beyond AI Computing

In a strategic move to expand its reach, CoreWeave recently announced plans to acquire Weights & Biases, a software startup helping companies manage AI workflows. This could ease its dependency on any single customer.

Still, despite the high stakes and looming competition, those who know CoreWeave’s founders say their hearts remain the same.

“They’re still traders at heart,” said Carter. “Even now, conversations drift back to sports betting and crypto.”